Anil Dhirubhai Ambani owns the Reliance Group, which includes Reliance Power Limited, commonly known as RPower. RPower, a small company in the Indian power sector, is seeking growth potential through its various energy and energy initiatives.

Reliance Power's primary business activity is developing, constructing, and managing power plants domestically and abroad. The portfolio of its power generation business module includes hydropower, solar, and wind power projects in addition to coal-based power facilities.

If you are an investor in Reliance Power or want to invest in this stock, then we discuss Reliance Power share price targets for 2025, 2026, 2027, 2028, 2029, and 2030 in this article.

Read more: ICICI Bank Share Price Target

About Reliance Power

Reliance Power Limited, originally called Reliance Energy Generation Limited, is a subsidiary of the Reliance Anil Dhirubhai Ambani Group. The firm was the sole distributor of energy in the suburbs of Mumbai until 2017, when it sold its Mumbai operations to Adani Power. The firm was founded on January 17, 1995, as Bawana Power Private Limited and was renamed Reliance Delhi Power Private Limited in February 1995. It was renamed Reliance Energy Generation Limited in March 2004, and then again in July 2007 as Reliance Power Limited.

Reliance Power Share Current Performance And Market Indicators

Open Price: ₹42.05

Today’s Low Price: ₹40.25

Today's High Price: ₹42.05

Current Price: ₹42.05

Market capitalization: ₹16,092 Cr

P/E Ratio: -8.60

ROE: -17.81%

Dividend Yield: 0.00%

52-Week Low: ₹15.55

52-Week High: ₹42.05

Price Change Over the Past Year: +22.95 (120.16% Increase)

Reliance Power shares have performed well recently, with the current price of ₹42.05 marking the stock's daily high. Over the past year, the stock has gained ₹22.95, or 120.16%. The stock price achieved a 52-week high of ₹42.05, indicating an uptrend, while the lowest price was ₹15.55. However, the firm is facing financial issues, with a negative P/E ratio of -8.60 and an ROE of -17.81%, indicating continued profitability concerns. Despite the financial challenges, investor confidence remains strong, as evident from the market capitalization of ₹16,092 crore. However, the dividend yield remains at 0%.

Reliance Power Share Price Target 2025

Anil Ambani pays full attention to Reliance Power while exploring this possibility. The company's management is working hard to reduce the company's debt. It is estimated that by December 2025, the price of RPower will reach ₹59.

Reliance Power Share Price Target 2026

In 2026, technological advancements and increasing market penetration could be key growth drivers for Reliance Power. The business company's investments in innovative technology and modern solutions will improve operational efficiency and lead to cost savings. According to technical data, the minimum share price target of RPOWER is likely to reach ₹79.

Reliance Power Share Price Target 2027

We also learned the monthly target estimate for 2027 as well as the probability of reaching the objective by December, when Reliance Power's first share price may reach ₹80 and its second share price may reach ₹86.

Reliance Power Share Price Target 2028

India's ongoing investments in infrastructure for renewable energy could result in Reliance Power's share price rising significantly by 2028. A target price of ₹97 to ₹110 is predicted by experts, with an emphasis on strategic execution.

Reliance Power Share Price Target 2029

Reliance Power will face significant challenges in 2029 as the world's energy environment continues to change. The organization's ability to form alliances and integrate new energy technology will be essential. In 2030, the first share price of Reliance Power could be ₹119, while the second share price could be ₹126.

Reliance Power Share Price Target 2030

The share price target for 2030 is influenced by several factors, such as the competitive environment, economic conditions, and breakthroughs in renewable energy. By 2030, technical indicators and fundamental research point to a potential rise of between ₹138.15 and ₹153.

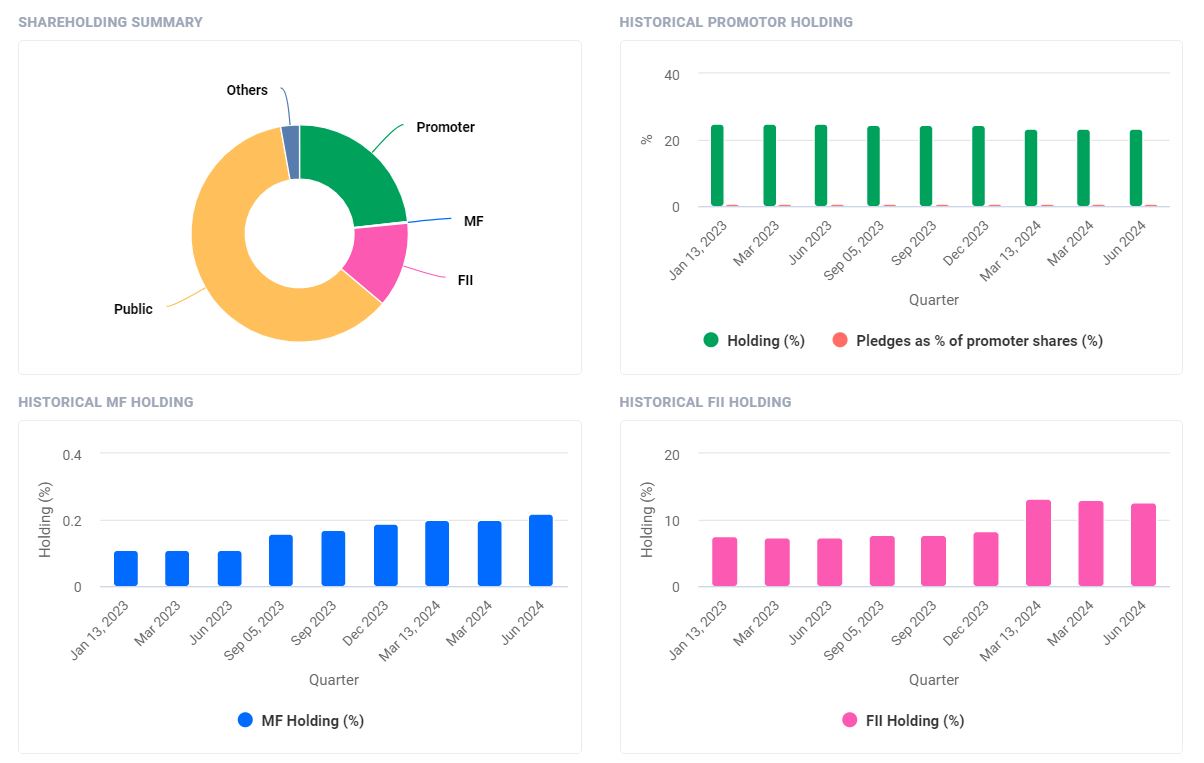

Reliance Power Shareholding

| Jun 2023 | Sep 2023 | Dec 2023 | Mar 2024 | Jun 2024 |

Retail and Other | 64.48% | 62.66% | 64.00% | 58.79% | 60.99% |

Promoters | 24.99% | 24.49% | 24.49% | 23.24% | 23.24% |

Foreign Institutions | 7.34% | 7.66% | 8.37% | 13.01% | 12.71% |

Other Domestic Institutions | 3.08% | 5.01% | 2.95% | 4.76% | 2.84% |

Mutual Funds | 0.11% | 0.17% | 0.19% | 0.20% | 0.22% |

The Reliance Power shareholding chart is referred to from the Groww website.

Read more: Manba Finance IPO Detiails

Reliance Power Balance Sheet

Balance Sheet of Reliance Power (in Rs. Cr.) | Mar 24 | Mar 23 | Mar 22 | Mar 21 | Mar 20 |

| 12 mths | 12 mths | 12 mths | 12 mths | 12 mths |

EQUITIES AND LIABILITIES |

|

|

|

|

|

SHAREHOLDER'S FUNDS |

|

|

|

|

|

Equity Share Capital | 4,016.98 | 3,735.21 | 3,400.13 | 2,805.13 | 2,805.13 |

Total Share Capital | 4,016.98 | 3,735.21 | 3,400.13 | 2,805.13 | 2,805.13 |

Reserves and Surplus | 5,380.17 | 5,050.31 | 5,594.39 | 6,081.51 | 6,001.81 |

Total Reserves and Surplus | 5,380.17 | 5,050.31 | 5,594.39 | 6,081.51 | 6,001.81 |

Total Shareholders Funds | 9,397.15 | 8,865.52 | 9,177.02 | 8,886.64 | 8,806.94 |

NON-CURRENT LIABILITIES |

|

|

|

|

|

Long Term Borrowings | 284.07 | 351.93 | 639.12 | 780.15 | 749.86 |

Deferred Tax Liabilities [Net] | 0 | 0 | 0 | 0 | 0 |

Other Long Term Liabilities | 0 | 4.04 | 6.28 | 9.05 | 27.53 |

Long Term Provisions | 1.22 | 1.36 | 0.55 | 0.02 | 0.95 |

Total Non-Current Liabilities | 285.29 | 357.33 | 645.95 | 789.22 | 778.34 |

CURRENT LIABILITIES |

|

|

|

|

|

Short Term Borrowings | 3,915.76 | 5,039.77 | 5,537.19 | 5,173.61 | 5,512.42 |

Trade Payables | 1.63 | 19.19 | 16.56 | 12.27 | 20.92 |

Other Current Liabilities | 1,206.82 | 1,680.81 | 2,105.92 | 2,705.46 | 2,317.54 |

Short Term Provisions | 0.02 | 1.04 | 0.58 | 0.72 | 0.35 |

Total Current Liabilities | 5,124.23 | 6,740.81 | 7,660.25 | 7,892.06 | 7,851.23 |

Total Capital And Liabilities | 14,806.67 | 15,963.66 | 17,483.22 | 17,567.92 | 17,436.51 |

ASSETS |

|

|

|

|

|

NON-CURRENT ASSETS |

|

|

|

|

|

Tangible Assets | 0.03 | 235.69 | 247.37 | 261.37 | 279.26 |

Intangible Assets | 0 | 0 | 0 | 0 | 0.07 |

Capital Work-In-Progress | 0 | 0 | 0 | 0 | 0 |

Other Assets | 0 | 0 | 0 | 0 | 0 |

Fixed Assets | 0.03 | 235.69 | 247.37 | 261.37 | 279.33 |

Non-Current Investments | 13,153.21 | 12,601.40 | 13,898.43 | 14,107.78 | 14,084.47 |

Deferred Tax Assets [Net] | 0 | 0 | 0 | 0 | 0 |

Long Term Loans And Advances | 0.97 | 1,333.69 | 1,333.60 | 1,332.78 | 1,328.01 |

Other Non-Current Assets | 32.46 | 28.88 | 30.89 | 39.83 | 42.94 |

Total Non-Current Assets | 13,186.67 | 14,199.66 | 15,510.29 | 15,741.76 | 15,734.75 |

CURRENT ASSETS |

|

|

|

|

|

Current Investments | 0 | 0 | 0 | 0 | 0 |

Inventories | 0 | 0 | 0 | 0 | 0 |

Trade Receivables | 0 | 59.84 | 60.42 | 60.28 | 60.98 |

Cash And Cash Equivalents | 12.74 | 2.14 | 6.86 | 6.1 | 19.09 |

Short Term Loans And Advances | 1,081.04 | 686.99 | 724.03 | 729.42 | 712.3 |

OtherCurrentAssets | 526.22 | 1,015.03 | 1,181.62 | 1,030.36 | 909.39 |

Total Current Assets | 1,620.00 | 1,764.00 | 1,972.93 | 1,826.16 | 1,701.76 |

Total Assets | 14,806.67 | 15,963.66 | 17,483.22 | 17,567.92 | 17,436.51 |

OTHER ADDITIONAL INFORMATION |

|

|

|

|

|

CONTINGENT LIABILITIES, COMMITMENTS |

|

|

|

|

|

Contingent Liabilities | 6,614.01 | 7,653.63 | 5,994.83 | 6,458.14 | 6,801.40 |

CIF VALUE OF IMPORTS |

|

|

|

|

|

Raw Materials | 0 | 0 | 0 | 0 | 0 |

Stores, Spares And Loose Tools | 0 | 0 | 0 | 0 | 0 |

Trade/Other Goods | 0 | 0 | 0 | 0 | 0 |

Capital Goods | 0 | 0 | 0 | 0 | 0 |

EXPENDITURE IN FOREIGN EXCHANGE |

|

|

|

|

|

Expenditure In Foreign Currency | 26.21 | 9.39 | 0.12 | 0.03 | 0.01 |

REMITTANCES IN FOREIGN CURRENCIES FOR DIVIDENDS |

|

|

|

|

|

Dividend Remittance In Foreign Currency | -- | -- | -- | -- | -- |

EARNINGS IN FOREIGN EXCHANGE |

|

|

|

|

|

FOB Value Of Goods | -- | -- | -- | -- | -- |

Other Earnings | -- | -- | -- | -- | 149.06 |

BONUS DETAILS |

|

|

|

|

|

Bonus Equity Share Capital | 136.8 | 136.8 | 136.8 | 136.8 | 136.8 |

NON-CURRENT INVESTMENTS |

|

|

|

|

|

Non-Current Investments Quoted Market Value | -- | -- | -- | -- | -- |

Non-Current Investments Unquoted Book Value | 13,153.21 | 12,601.40 | 13,898.43 | 14,107.78 | 14,084.47 |

CURRENT INVESTMENTS |

|

|

|

|

|

Current Investments Quoted Market Value | -- | -- | -- | -- | -- |

Current Investments Unquoted Book Value | -- | -- | -- | -- | -- |

Read more: BEL Share Price Target

Conclusion

Our 2024, 2025, 2026, 2027, 2028, 2029, and 2030 Reliance Power share price targets are derived from the latest trading data and algorithms. For the coming years, these targets represent potential levels of support and resistance. Reliance Power's transformation from a traditional power technology company to a diversified power company with a significant focus on renewable energy is a testament to its strategic vision and execution.

FAQs

1. Is it good to buy Reliance Power shares?

As per the current guidelines, Reliance Power shares are a smart buy for both new and existing investors at this time. Investors are advised to hold with a stop loss of ₹35, and short-term targets of ₹45 and ₹50. New investors can also join using the same objectives and stop losses.

2. What is the target of Reliance Power in 2025?

The Reliance Power share price target for 2025 is around ₹59 to ₹68.

3. Does Reliance Power have a future?

Reliance Power has a bright future indeed. To meet India's growing energy needs, the corporation is focused on increasing its thermal and renewable energy resources. It seeks to provide a stable supply of energy with the goals of improving thermal power generation and matching with the government's aspirations for coal-based energy.

4. Is Adani buying Reliance Power?

When the financing dispute is resolved, the Adani Group will buy the Butibori thermal power plant from Reliance Power. This acquisition will increase Adani's energy portfolio and strengthen its position in the market.

Disclaimer

This article is just for informational purposes. Forecasting of the share price targets is based on and referred to from various sources, media reports, and predictions done by brokerage houses from time to time.

We also state that we are not SEBI-registered financial advisors. So, kindly, before taking any kind of investment in the shares, please do counsel with the certified financial advisories.

If you have any corrections or find any wrong information, do let us know at our official [email protected].