Investors hoping to reap significant gains should pay close attention to BEL share price targets. A major player in India's electronics and military industries, Bharat Electronics Limited (BEL) has consistently shown strong financial performance and scope for expansion.

It offers digital government solutions, cybersecurity, electric car technology, railroad systems, civilian radar systems, homeland security, complete project management, electronic components and equipment, telecommunications, and broadcast systems. India has included this firm among the Navratnas.

We will examine in this post how Bharat Electronics Limited's share price will change over the next several years. Here are the BEL share price targets for 2024, 2025, 2026, 2027, 2028, 2029, and 2030.

Read more: Western Carriers IPO

About Bharat Electronics Limited (BEL) Company

Bharat Electronics Limited (BEL) is an Indian public sector aerospace and defense electronics company. Its main production is state-of-the-art electrical equipment for aeronautical and ground use. Bharat Electronics Limited was established in 1954 in Bangalore, Karnataka, India.

Under the government's decentralization program and for strategic purposes, BEL established additional units at various locations across the country. To provide radar and tropocommunication equipment to the Indian Air Force, BEL's second facility was established at Ghaziabad in 1974.

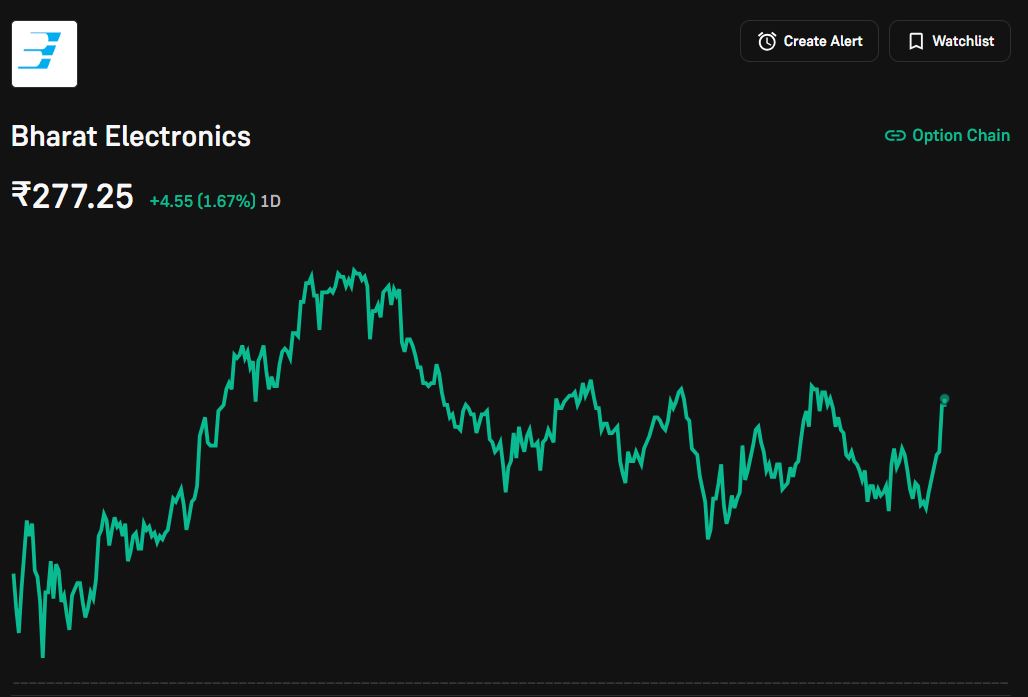

BEL Share Current Performance And Market Indicators

Open Price: ₹274.00

Today’s Low Price: ₹272.85

Today's High Price: ₹279.40

Current Price: ₹276.60

Market capitalization: ₹1,99,374 Cr

P/E Ratio: 47.03

ROE: 24.41%

Dividend Yield: 0.81%

52-Week Low: ₹127.00

52-Week High: ₹340.50

Price Change Over the Past Year: +136.80 (97.71% Increase)

BEL's share price performance is now showing strong momentum. The stock opened today at ₹274.00 and moved between a high of ₹279.40 and a low of ₹272.85 to ₹276.60. The stock has gained ₹136.80 or 97.71% in the past year. With a market cap of ₹1,99,374 crore, BEL remains a notable player in the industry.

The return on equity (ROE) is good at 24.41%, indicating strong profitability, while the P/E ratio is 47.03, indicating premium pricing. A low dividend yield of 0.81% also provides income to investors. The stock now trades between ₹27.00 and ₹340.50, its 52-week range.

BEL Share Price Target 2024

In 2023, BEL and other Indian stocks performed well. In early 2024, this pattern may still exist with some stability. If the market remains positive, BEL's price may reach ₹310.22 by the end of 2024.

BEL Share Price Target 2025

The target share price for BEL is expected to be ₹348.76 by 2025. This target is based on the company's expected continued growth, which will be fueled by rising defense spending, worldwide market growth, and continued technological innovation.

BEL Share Price Target 2026

Bharat Electronics (BEL) is often seen collaborating with other businesses in its industry to create new products and stay abreast of emerging technology, while also keeping an eye on the future. By the end of the year, it is estimated that BEL share price target 2026 will reach ₹355.63.

BEL Share Price Target 2027

Investors in Bharat Electronics Limited can be divided into four categories. The proportion of investors in each stock also affected the company's growth. The share target for Bharat Electronics Limited is ₹426.52 in 2027.

BEL Share Price Target 2028

Looking ahead to 2028, the BEL share price target is around ₹495 in the year-end. BEL is expected to see a significant increase in demand for both defense and non-defense products.

BEL Share Price Target 2029

At present, the book value of BEL company shares is ₹277.20. Experts estimate that by 2026 its price can be from ₹479.00 to ₹522.35.

BEL Share Price Target 2030

BEL is expected to benefit from India's push to indigenize the defense industry by 2030. The government's efforts to increase military production in India will increase BEL's profitability and market share. If this trend continues, the stock could reach ₹648.87 by the end of the year.

Read more: Trent Share Price Target

BEL Shareholding

| Jun 2023 | Sep 2023 | Dec 2023 | Mar 2024 | Jun 2024 |

Promoters | 51.14% | 51.14% | 51.14% | 51.14% | 51.14% |

Foreign Institutions | 17.35% | 17.18% | 17.78% | 17.56% | 17.43% |

Mutual Funds | 19.33% | 18.85% | 18.33% | 18.06% | 16.08% |

Retail and Other | 7.90% | 8.78% | 7.72% | 8.66% | 10.82% |

Other Domestic Institutions | 4.28% | 4.05% | 5.03% | 4.58% | 4.53% |

The BEL shareholding chart is referred to from the Groww website.

BEL Balance Sheet

Balance Sheet of Bharat Electronics (in Rs. Cr.) | Mar 24 | Mar 23 | Mar 22 | Mar 21 | Mar 20 |

| 12 mths | 12 mths | 12 mths | 12 mths | 12 mths |

EQUITIES AND LIABILITIES |

|

|

|

|

|

SHAREHOLDER'S FUNDS |

|

|

|

|

|

Equity Share Capital | 730.98 | 730.98 | 243.66 | 243.66 | 243.66 |

Total Share Capital | 730.98 | 730.98 | 243.66 | 243.66 | 243.66 |

Reserves and Surplus | 15,351.41 | 12,851.01 | 11,740.60 | 10,564.23 | 9,609.28 |

Total Reserves and Surplus | 15,351.41 | 12,851.01 | 11,740.60 | 10,564.23 | 9,609.28 |

Total Shareholders Funds | 16,082.39 | 13,581.99 | 11,984.26 | 10,807.89 | 9,852.94 |

NON-CURRENT LIABILITIES |

|

|

|

|

|

Long Term Borrowings | 0 | 0 | 0 | 0 | 0 |

Deferred Tax Liabilities [Net] | 0 | 0 | 0 | 0 | 0 |

Other Long Term Liabilities | 122.14 | 124.71 | 133.59 | 73.1 | 119.55 |

Long Term Provisions | 961.04 | 838.97 | 1,800.06 | 1,407.44 | 1,160.57 |

Total Non-Current Liabilities | 1,083.18 | 963.68 | 1,933.65 | 1,480.54 | 1,280.12 |

CURRENT LIABILITIES |

|

|

|

|

|

Short Term Borrowings | 0 | 0 | 0 | 0 | 0 |

Trade Payables | 3,693.65 | 3,319.66 | 3,365.96 | 3,296.54 | 2,424.75 |

Other Current Liabilities | 17,607.43 | 16,566.00 | 15,750.44 | 13,125.72 | 10,037.92 |

Short Term Provisions | 689 | 623.15 | 415.63 | 342.46 | 315.36 |

Total Current Liabilities | 21,990.08 | 20,508.81 | 19,532.03 | 16,764.72 | 12,778.03 |

Total Capital And Liabilities | 39,155.65 | 35,054.48 | 33,449.94 | 29,053.15 | 23,911.09 |

ASSETS |

|

|

|

|

|

NON-CURRENT ASSETS |

|

|

|

|

|

Tangible Assets | 2,699.11 | 2,596.30 | 2,454.51 | 2,422.65 | 2,496.63 |

Intangible Assets | 59.78 | 75.83 | 69.05 | 57.3 | 22.97 |

Capital Work-In-Progress | 453.77 | 361.57 | 398.55 | 350.69 | 199.44 |

Other Assets | 0.04 | 0.06 | 0.07 | 0.08 | 0.09 |

Fixed Assets | 3,650.00 | 3,513.46 | 3,382.63 | 3,216.28 | 3,202.56 |

Non-Current Investments | 767.79 | 664.4 | 1,554.24 | 1,331.19 | 1,161.67 |

Deferred Tax Assets [Net] | 574.16 | 503.39 | 620.7 | 463.39 | 497.4 |

Long Term Loans And Advances | 7.03 | 6.56 | 7.28 | 33.24 | 33.09 |

Other Non-Current Assets | 265.52 | 463.39 | 727.93 | 393.06 | 369.23 |

Total Non-Current Assets | 5,264.50 | 5,151.20 | 6,292.78 | 5,437.16 | 5,263.95 |

CURRENT ASSETS |

|

|

|

|

|

Current Investments | 0 | 0 | 0 | 0 | 0 |

Inventories | 7,407.59 | 6,406.18 | 5,539.56 | 4,954.67 | 3,962.75 |

Trade Receivables | 7,362.19 | 7,022.01 | 6,103.39 | 6,551.54 | 6,732.91 |

Cash And Cash Equivalents | 10,968.10 | 8,009.00 | 7,499.14 | 5,008.21 | 1,557.70 |

Short Term Loans And Advances | 1.41 | 1.72 | 1.48 | 19.46 | 32.62 |

OtherCurrentAssets | 8,151.86 | 8,464.37 | 8,013.59 | 7,082.11 | 6,361.16 |

Total Current Assets | 33,891.15 | 29,903.28 | 27,157.16 | 23,615.99 | 18,647.14 |

Total Assets | 39,155.65 | 35,054.48 | 33,449.94 | 29,053.15 | 23,911.09 |

OTHER ADDITIONAL INFORMATION |

|

|

|

|

|

CONTINGENT LIABILITIES, COMMITMENTS |

|

|

|

|

|

Contingent Liabilities | 4,455.23 | 3,147.36 | 2,607.83 | 2,484.55 | 2,739.02 |

CIF VALUE OF IMPORTS |

|

|

|

|

|

Raw Materials | 0 | 0 | 0 | 0 | 0 |

Stores, Spares And Loose Tools | 0 | 0 | 0 | 0 | 0 |

Trade/Other Goods | 0 | 0 | 0 | 0 | 0 |

Capital Goods | 0 | 0 | 0 | 0 | 0 |

EXPENDITURE IN FOREIGN EXCHANGE |

|

|

|

|

|

Expenditure In Foreign Currency | 0 | 0 | 0 | 0 | 0 |

REMITTANCES IN FOREIGN CURRENCIES FOR DIVIDENDS |

|

|

|

|

|

Dividend Remittance In Foreign Currency | -- | -- | -- | -- | -- |

EARNINGS IN FOREIGN EXCHANGE |

|

|

|

|

|

FOB Value Of Goods | -- | -- | -- | -- | -- |

Other Earnings | -- | -- | -- | -- | -- |

BONUS DETAILS |

|

|

|

|

|

Bonus Equity Share Capital | 171.25 | 171.25 | 171.25 | 171.25 | 171.25 |

NON-CURRENT INVESTMENTS |

|

|

|

|

|

Non-Current Investments Quoted Market Value | -- | -- | -- | -- | -- |

Non-Current Investments Unquoted Book Value | 767.79 | 664.4 | 1,554.24 | 1,331.19 | 1,161.67 |

CURRENT INVESTMENTS |

|

|

|

|

|

Current Investments Quoted Market Value | -- | -- | -- | -- | -- |

Current Investments Unquoted Book Value | -- | -- | -- | -- | –

|

This balance sheet is referred to from the MoneyControl website.

Read more: Hero Motocorp Share Price Target

Conclusion

Being an Indian Navaratna company, BEL has excellent growth potential due to supportive government policies, its order book of over $100 billion, its diversification outside the military industry, and the growing importance of exports. Substantial value growth is expected, making BEL a desirable investment option in the growing military industry.

FAQs

1. What is the target price of BEL in 2025?

Bharat Electronics share price financial forecast in 2025 is around ₹348.76.

2. Is BEL a government company?

Bharat Electronics Limited (BEL) is a Navratna PSU under the Ministry of Defense, Government of India.

3. Is BEL a large cap company?

Yes, it is a Large Cap company with a market capitalization of ₹ 2,07,744 Cr as of 2024.

4. Is BEL a debt free company?

Yes, BEL is a debt free company.

Disclaimer

This article is just for informational purposes. Forecasting of the share price targets is based on and referred to from various sources, media reports, and predictions done by brokerage houses from time to time.

We also state that we are not SEBI-registered financial advisors. So, kindly, before taking any kind of investment in the shares, please do counsel with the certified financial advisories.

If you have any corrections or find any wrong information, do let us know at our official [email protected].